top of page

NEWS & RESOURCES

Search

AB 762 Passed Committee, But the Fight Isn't Over: Here's What California Cannabis Operators Need to Know

If you operate a cannabis business in California, you have standing in this conversation. You have data about what AB 762 means for your business, your employees, and your customers.

Jan 15

AB 762 Would Ban Cannabis Vapes and Empower California's Illicit Market: Here's What Retailers Need to Know

This Tuesday, January 13th, the Assembly Business and Professions Committee will consider Assembly Bill 762 (Irwin), legislation that would prohibit the sale of all-in-one (AIO) cannabis vapes in California. The California Cannabis Operators Association (CaCOA) strongly opposes this bill and has submitted a letter explaining why it is fundamentally flawed.

Jan 8

New California Data Shows AB 564 Was the Right Call at the Right Time

When Governor Gavin Newsom signed Assembly Bill 564 (Haney) into law this fall, California made a critical decision to protect the public health and safety of cannabis consumers and the community programs that rely on cannabis excise taxes for funding. The bill, which repealed an automatic tax increase and locked the excise tax at 15% until at least 2028, was sound and necessary. And the early data now proves it.

Dec 11, 2025

California Cannabis Advocacy Wins and Future Directions

If you missed our recent webinar, here's what you need to know about the latest California cannabis advocacy wins and where we're heading next.

Dec 2, 2025

Understanding AB 8: A Guide for Cannabis Operators

Ultimately, AB 8 ensures that California’s cannabis and hemp policies advance together, grounded in science, fairness, and, most importantly, public safety.

Oct 23, 2025

California Cannabis Industry Wins Big: How Advocacy Rolled Back a Tax Hike and Regulated Hemp

Now comes the more complex work of building the legal cannabis market California deserves: one that expands access to safe, regulated products, unleashes innovation to create jobs, and generates sustainable tax revenue for the community programs that depend on it.

Oct 20, 2025

AB 564 will Protect Public Health/Safety & Community Program Funding

The legal cannabis market is in crisis, with declining sales, widespread business closures, and plummeting tax revenue. Assembly Bill 564 (Haney) restores the excise tax rate from 19% to 15%, a critical step to protect public health and stabilize the legal market. This bipartisan legislation has received widespread support in both chambers and from Governor Newsom.

Aug 27, 2025

Victory: AB 8 and AB 564 Pass Senate Revenue and Taxation Committee with Unanimous Support

California's legal cannabis industry achieved a crucial milestone this week as both AB 564 and AB 8 passed out of the Senate Revenue and Taxation Committee with unanimous support, a testament to the collective advocacy efforts of the California Cannabis Operators Association.

Jul 10, 2025

Take Action: Tell #CAleg Senate to Vote Yes on #AB564

Have you heard? Californians are now paying 25% more in taxes on safe, legal, and regulated cannabis products. Ironically, this tax...

Jul 1, 2025

Setting the Record Straight: What’s Really in Governor Newsom’s Cannabis Enforcement Proposal

Governor Newsom’s revised 2025–26 state budget proposes a comprehensive strategy to combat California’s persistent illicit cannabis market. This strategy is operationalized through two complementary trailer bills: (1) expanded enforcement authority for the Department of Cannabis Control (DCC), and (2) amendments to Proposition 64 to reallocate enforcement funding.

Jun 3, 2025

Big Wins on Suspense Day for CaCOA and the Cannabis Industry

“We're thrilled to report that all of our priority bills moved forward,” said Amy O’Gorman Jenkins, Executive Director of CaCOA. “This is a huge accomplishment that reflects the power of unified advocacy, strong partnerships, and sound policy."

May 23, 2025

CaCOA Makes Urgent Case Against Cannabis Excise Tax Increase at Revenue & Taxation Hearing

The California Cannabis Operators Association (CaCOA) delivered powerful testimony before the Assembly Revenue & Taxation Committee on May 5, 2025, in support of AB 564 (Haney), which would halt the scheduled increase in the cannabis excise tax from 15% to 19% set to take effect July 1, 2025.

May 5, 2025

Victory for Cannabis Consumers and Retailers: AB 762 Pulled from Committee

We are grateful to the Assembly Business and Professions Committee members for recognizing the problematic aspects of AB 762. While we always appreciate the legislature's attention to environmental concerns, this bill would have created severe unintended consequences for patients, consumers, and our struggling legal cannabis industry. The committee's decision reflects thoughtful consideration of such a ban's real-world impacts on public health and safety.

Apr 29, 2025

CaCOA Sponsors AB 1027 to Strengthen Cannabis Testing Standards and Consumer Protection

Amy O'Gorman Jenkins, representing CaCOA, outlined how the organization is "proud to sponsor AB 1027 by Assemblymember Sharp-Collins, a measured and thoughtful bill that strengthens oversight of cannabis testing to improve transparency, support enforcement consistency, and reinforce consumer confidence in California's cannabis market."

Apr 28, 2025

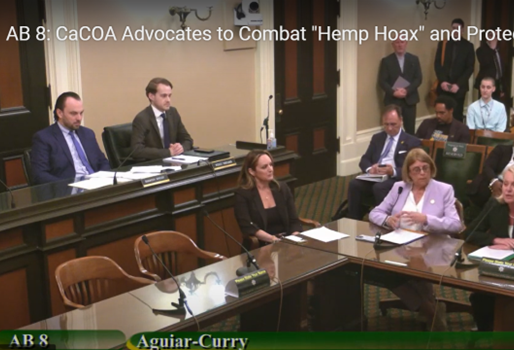

CaCOA Advocates for AB 8 to Combat "Hemp Hoax" and Protect Legal Cannabis Market

Amy O'Gorman Jenkins, representing CaCOA, presented compelling testimony outlining how unregulated products masquerading as “hemp” are undermining public health, consumer safety, and California's regulated cannabis industry.

Apr 27, 2025

CaCOA Continues Fight Against Intoxicating Hemp Products at Assembly Hearing (AB 8)

On April 22, our Executive Director Amy O'Gorman Jenkins testified before the Assembly Business and Professions Committee in support of Assembly Bill 8 (Aguiar-Curry), legislation co-sponsored by the California Cannabis Operators Association (CaCOA) to address the growing threat of unregulated intoxicating hemp products flooding the legal market.

Apr 23, 2025

(update!) OPPOSE AB 762 / Vape Ban

Rather than implementing a counterproductive ban through AB 762 that would endanger public health and strengthen the illicit market, California should focus on 1) enhancing education about proper disposal methods established by AB 1894 (2022), 2) expanding regulated collection programs, and 3) directing enforcement resources toward unlicensed operators who sell untested, potentially harmful vaporizers with no environmental or safety standards.

Apr 14, 2025

(update!) CaCOA Opposes Vape Ban: Testimony Highlights Environmental and Public Health Concerns

Jenkins emphasized that while CaCOA shares lawmakers' commitment to environmental and consumer protection, banning integrated vaporizers would likely exacerbate existing challenges without solving the intended problems.

Apr 8, 2025

CaCOA Joins Assemblymember Haney to Urge Immediate Passage of AB 564 to Halt the Cannabis Excise Tax Hike

“Raising taxes in a shrinking market is shortsighted and fiscally irresponsible,” said Freedman. “AB 564 will help level the playing field, protect jobs, and keep California competitive in the national cannabis economy. We thank Assemblymember Haney for his leadership and urge the Legislature to act before it’s too late.”

Mar 25, 2025

Cannabis Industry in Crisis: CaCOA Fights Against Excise Tax Increase at California Assembly Budget Hearing

In powerful testimony before the California Assembly Budget Subcommittee No. 5 today, CaCOA Executive Director Amy O'Gorman Jenkins delivered a stark reality check about the state's struggling legal cannabis market and urged immediate legislative action to prevent the looming excise tax increase that threatens to devastate California's licensed cannabis businesses.

Mar 24, 2025

bottom of page

.png)